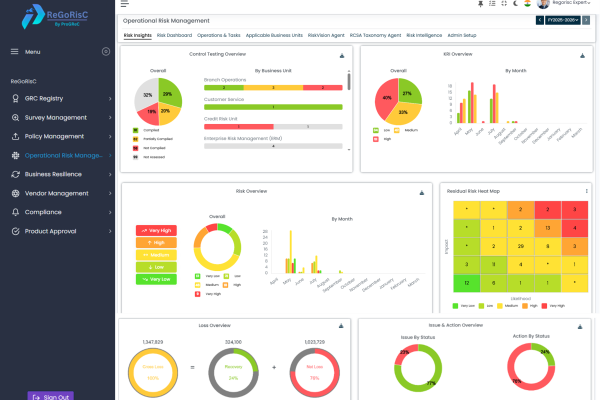

Operational Risk Management (ORM)

Transforming Uncertainty into Resilience

AI-powered Operational Risk Management for Banks, NBFCs, Fintechs, and Enterprises.

Move from reactive risk control to predictive resilience — all in one intelligent platform.

In Today’s World, Risk Is Not an Exception — It’s the Environment

Organizations face a relentless wave of regulatory changes, digital disruptions, and operational dependencies. Yet, most still manage risk using spreadsheets, emails, and static reports — a reactive approach that leaves blind spots.

ReGoRisC ORM changes that. Built by risk practitioners, it transforms how you identify, assess, and respond to operational risks — empowering your business with visibility, predictability, and accountability.

AI-Driven Operational Risk Management for Modern Enterprises

Automate your risk assessments, control testing, and KRI monitoring with intelligent insights that predict issues before they happen.

Centralized Risk Register

Maintain a unified risk repository to identify, assess, and prioritize enterprise risks.

RCSA Automation

Streamline assessments and scoring with automated workflows and real-time dashboards.

Key Risk Indicators (KRIs)

Monitor dynamic early warning metrics for proactive action.

Issue & Action Tracking

Assign, track, and close remediation actions with full audit trail.

Loss Event Management

Capture, analyze, and report operational loss incidents.

Predictive Risk Intelligence

Harness AI to forecast risk trends and emerging vulnerabilities.

Risk Dashboards & Reports

Deliver board-ready visualizations and heatmaps that tell the risk story.

👉 See How AI Makes ORM Predictive → Request a Demo

How ReGoRisC ORM Solves Real-World Risk Challenges

Automate RBI ORM compliance, monitor operational KRIs, and align with your risk appetite.

Manage API downtime, data breaches, and SLA-based third-party risks.

Strengthen supply chain visibility and integrate ORM with BCM programs.

Enable evidence-based assurance mapped to ISO 31000, COSO, and Basel III.

Beyond ORM — A Unified GRC Ecosystem

Operational risk connects with every aspect of your enterprise. ReGoRisC ensures it stays that way.

Track supplier risk, due diligence, and SLA breaches.

Link operational risks with continuity scenarios and DR testing.

Map RBI, SEBI, FIU, and ISO obligations to ORM controls.

Correlate incidents and vulnerabilities with compliance workflows..

🔗 Explore the Full ReGoRisC GRC Suite → View All Modules

Built by Practitioners. Powered by AI. Designed for Resilience.

🧩

Practitioner-Led Design

Built by risk officers, auditors, and compliance professionals for real-world usability.

🤖

AI-Native & Predictive

Learns from incidents, KRIs, and assessments to forecast risks and recommend mitigation.

🔄

Unified GRC Ecosystem

Connect ORM with VRM, BCM, and Compliance — no silos, no duplication.

🌟 Supporting Features

- Agentic Automation with AI Risk Agents

- Cloud-agnostic deployment (AWS, Azure, OCI)

- Regulatory libraries: RBI, SEBI, FIU, ISO, COSO

- Continuous updates under ProGReC’s “Simple, Adaptable, Sustainable GRC” philosophy

“ReGoRisC doesn’t just automate GRC — it humanizes it. It empowers every risk owner and executive to see, understand, and act on risk — with confidence.”

Take Control of Your Operational Risks

Operational risk is inevitable — unmanaged risk is optional. Discover how ReGoRisC ORM helps your organization move from reactive management to predictive resilience.